Welcome to the delightful world of Macroeconomics books, where numbers and theories tango across the pages and make your head spin with excitement! Ever wondered how those pesky economic policies affect your morning coffee prices or why your wallet feels lighter after a holiday? Well, grab your favorite reading chair, because we’re about to embark on a thrilling journey through the top macroeconomic masterpieces that have shaped our understanding of the global economy.

From the minds of brilliant authors to the application of theories in real life, these books don’t just sit on shelves gathering dust; they offer insights that can help you navigate the financial labyrinth of everyday life. Let’s dive into summaries, key contributions, and the real-world magic that macroeconomic principles can perform when they’re not busy making your head hurt!

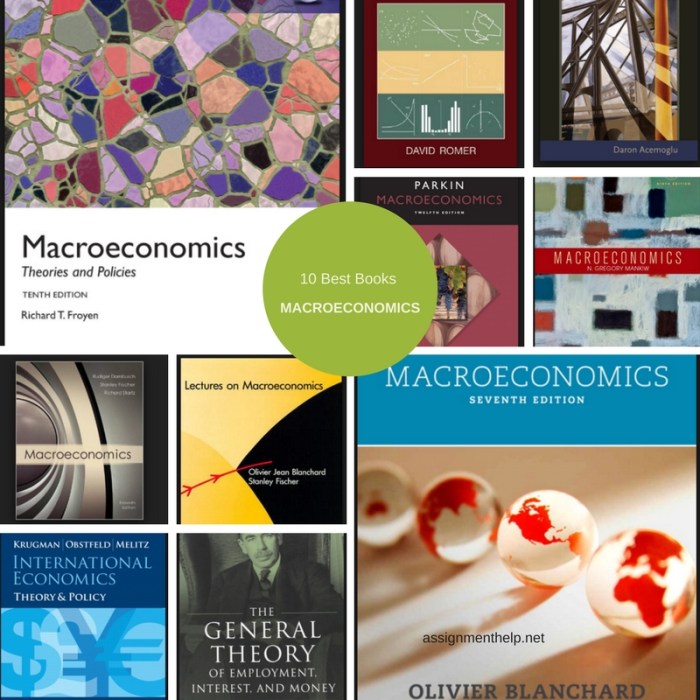

Popular Macroeconomics Books

In the vast and sometimes dizzying world of economics, certain books have managed to rise above the rest, grabbing the spotlight and demanding a round of applause (or at least a nod of appreciation) from scholars and students alike. In the past decade, a handful of macroeconomics books have not only stirred the pot but also reshaped the way we think about the economy.

Let’s dive into the crème de la crème, the top five macroeconomic tomes that have made waves and left an indelible mark on modern thought.

Top Five Macroeconomics Books

These influential works have become essential reading for anyone wanting to navigate the turbulent waters of global economies and understand the forces at play. Here’s a look at these literary giants and what makes them tick:

-

Capital in the Twenty-First Century by Thomas Piketty

“The history of capital is also the history of inequality.”

This groundbreaking book examines the dynamics of wealth concentration and distribution across the ages. With a meticulous analysis of data, Piketty argues that, without intervention, the rich will continue to get richer while the poor will be left behind, much like that one sock that disappears in the laundry. His insights have led to a global conversation about wealth inequality and taxes.

-

The Great Escape by Angus Deaton

“The most important thing that we can do is to end poverty in our time.”

Deaton explores the relationship between wealth, health, and happiness, emphasizing that economic growth alone does not guarantee improvement in our quality of life. His narratives from various societies illuminate how income and living conditions affect overall wellbeing, sparking discussions about economic policy focused on improving lives rather than merely boosting GDP.

-

Macroeconomics by N. Gregory Mankiw

“Economics is a science of decision-making.”

Mankiw’s textbook has become a staple in economics courses around the globe. Its clear explanations of macroeconomic principles, from GDP to inflation, are punctuated with real-world applications and humor. He elegantly presents complex concepts, making them accessible to students and budding economists, while influencing the pedagogy of economics education.

-

The General Theory of Employment, Interest, and Money by John Maynard Keynes

“The difficulty lies, not in the new ideas, but in escaping the old ones.”

Though published in 1936, Keynes’s masterpiece has seen a renaissance in recent years, particularly following the 2008 financial crisis. His ideas on government intervention and fiscal policy to manage economic downturns are increasingly relevant today, influencing modern macroeconomic policies and sparking debates on the role of the state in the economy.

-

Freakonomics by Steven D. Levitt and Stephen J. Dubner

“Incentives are the cornerstone of modern life.”

This unconventional book applies economic theory to diverse fields like crime and education, proving that economics isn’t just about numbers but also about human behavior and incentives. Its engaging style and real-life examples have broadened the appeal of economics, attracting a wider audience and encouraging them to view the world through an economic lens.

Each of these books has significantly contributed to modern macroeconomic thought, challenging pre-existing notions and encouraging readers to think critically about economic policies, social justice, and the future of wealth distribution.

Key Authors in Macroeconomics

In the vast and sometimes baffling world of macroeconomics, a handful of authors have emerged as titans, wielding pens like swords and crafting theories that shape policies, stir debates, and even keep some economists up at night. Their insights into the grand orchestra of economic forces resonate well beyond the pages of their books, influencing everything from government policies to your favorite café’s pricing strategy.

Let’s dive into the contributions of these key figures and explore their unique writing styles and impacts.

Prominent Authors and Their Contributions

The realm of macroeconomics has been enriched by several influential authors whose theories and analyses have paved the way for modern economic thought. Here are a few notable figures and their groundbreaking contributions:

- John Maynard Keynes: Often heralded as the father of modern macroeconomics, Keynes introduced the revolutionary idea that aggregate demand—total spending in the economy—drives economic activity. His work, particularly “The General Theory of Employment, Interest, and Money” (1936), suggested that during recessions, active government intervention is essential to stimulate demand. This was like telling a sluggish engine to stop whining and just get a booster shot of fiscal policy!

- Milton Friedman: A staunch advocate of free markets and minimal government intervention, Friedman challenged Keynesian views with his monetarism, highlighting the importance of controlling the money supply. His famous phrase, “Inflation is always and everywhere a monetary phenomenon,” succinctly encapsulates his belief that managing money supply is key to addressing inflation. He’s the guy who’d tell you the only thing more dangerous than a budget deficit is a poorly managed monetary policy.

- Paul Samuelson: The first American to win the Nobel Prize in Economic Sciences, Samuelson’s textbook, “Economics,” has educated generations. He integrated Keynesian economics with neoclassical theory, emphasizing the need for a balance between market forces and government intervention. You could say he was the economic equivalent of that one friend who always knows when to play hardball and when to go soft.

- Joseph Stiglitz: Known for his work on information asymmetry and market failures, Stiglitz has authored numerous papers and books arguing that markets are often inefficient and that government intervention is necessary to correct these failures. His insights have shaped policies on issues ranging from global trade to labor markets. Think of him as the economic detective, uncovering all the hidden clues that economists often overlook.

Comparison of Writing Styles

The writing styles of macroeconomic authors vary greatly, often reflecting their underlying philosophies and target audiences. Here’s how a few of them stack up against each other:

- Keynes employed a blend of approachable yet scholarly language, making complex theories digestible for readers. His anecdotes and real-world examples invite readers into the economic discourse as if at a cozy dinner party.

- Friedman, on the other hand, had a penchant for clarity and precision, often using graphs and straightforward language. His writings, while rigorous, are infused with wit and sarcasm, making them as entertaining as they are educational.

- Samuelson’s style is academic but accessible, often laced with historical references that provide context. His ability to weave narratives around economic theories makes his textbooks feel less like dry tomes and more like engaging stories.

- Stiglitz utilizes a blend of narrative and rigorous analysis, often incorporating personal anecdotes that humanize complex economic issues. His writing tends to challenge the status quo, pushing readers to rethink their assumptions, which can be both enlightening and intimidating.

Impact on Economic Policies

The works of these authors have not just filled libraries; they have also shaped economic policies across the globe. Here are some key insights into their impact:

- Keynes‘ theories led to the widespread adoption of fiscal policies aimed at combating economic downturns, notably influencing the New Deal in the United States. His ideas transformed how governments approached economic crises, akin to a doctor prescribing a robust treatment plan for a stubborn illness.

- Friedman’s advocacy for monetarism influenced central banking practices, particularly in the late 20th century, prompting a shift towards controlling money supply rather than focusing solely on fiscal measures. His ideas calmed the waters during turbulent inflationary periods, like a skilled captain steering a ship through a storm.

- Samuelson’s textbook became a staple in economics curricula worldwide, standardizing economic education and influencing the next generations of economists and policymakers. His ability to simplify complex ideas helped shape a more informed electorate, fostering better public debates around economic issues.

- Stiglitz’s research on market inefficiencies has informed various policy discussions, particularly regarding global trade agreements and financial regulations. His work encourages policymakers to consider the hidden dimensions of economic interactions, like a magician revealing the tricks behind his best illusions.

Application of Macroeconomics in Real Life

Macroeconomics isn’t just a collection of theories buried in dusty textbooks; it’s a living, breathing part of our everyday lives. From the price of your morning coffee to the stability of global markets, the principles of macroeconomics shape the landscape of our financial decisions. Let’s take a journey through the practical applications of these theories and see how they influence not only the economy but also the choices we make on a daily basis.Real-world applications of macroeconomic theories can be observed in various aspects of daily life.

For instance, when consumers face inflation, they might think twice before splurging on that fancy avocado toast. Similarly, interest rates influence whether you’ll take out a loan for that dream home or simply settle for a cozy shoebox. Understanding these dynamics helps consumers navigate their financial pathways, making informed choices that resonate far beyond their wallets.

Impact of Fiscal and Monetary Policies

Fiscal and monetary policies are tools wielded by governments and central banks that have profound effects on national economies and individual financial situations. These policies help manage economic stability and growth, ultimately affecting everyone from the average consumer to multinational corporations. Consider the following examples of how these policies function in the real world:

- Interest Rates: When the central bank lowers interest rates, borrowing becomes cheaper. This encourages consumers to take out loans for big purchases, leading to increased spending and economic growth. On the flip side, when rates rise, you might think long and hard about that new car.

- Tax Cuts: A reduction in taxes means more disposable income for families, which can lead to higher consumer spending. For instance, in 2017, the U.S. tax cut led to a spending spree, helping to boost the economy, but it’s a tightrope walk balancing between stimulating growth and overspending.

“Fiscal and monetary policies are like a chef’s seasoning; too much of one ingredient can spoil the whole dish.”

Case Studies Illustrating Macroeconomic Policies

Examining specific case studies can shed light on how macroeconomic policies have shaped global economies. Let’s delve into a few notable instances that highlight the consequences of these decisions:

- The 2008 Financial Crisis: This crisis serves as a prime example of the repercussions of lax monetary policy and regulatory oversight. The U.S. housing market bubble burst, leading to a global recession, demonstrating how interconnected economies can be affected by domestic policies.

- Germany’s Economic Policies Post-World War II: After WWII, Germany adopted a policy of social market economy focusing on free market principles while ensuring social welfare. This approach helped rebuild the economy effectively, turning it into one of the strongest in Europe.

- Japan’s Lost Decade: In the 1990s, Japan faced stagnation due to an asset price bubble burst and poor macroeconomic management. The effects of these policies were felt for years, impacting employment and economic growth.

“Macroeconomic policies can be the wind beneath an economy’s wings or the storm that capsizes the ship.”

The application of macroeconomics in everyday life is a vivid tapestry woven from fiscal strategies and monetary principles that influence our decisions, investments, and the very structure of the global economy. Understanding these connections equips individuals with the knowledge to make better financial choices while navigating an ever-changing economic landscape.

Closure

And there you have it, folks! A whirlwind tour through the captivating realm of Macroeconomics books that could make even the most mundane economic concepts feel like a blockbuster movie. Whether you’re hoping to impress your friends with your newfound economic savvy or simply want to understand why the economy behaves like a moody teenager, these books have got you covered.

So, dust off that library card, hit the books, and prepare for a brainy adventure that’s anything but boring!

Q&A

What are the best Macroeconomics books for beginners?

Start with titles like “Macroeconomics for Dummies” and “Principles of Macroeconomics” for an easy yet informative introduction.

How do I choose the right Macroeconomics book for my needs?

Consider your background knowledge, what specific topics interest you, and whether you prefer a more theoretical or practical approach.

Are there any Macroeconomics books that focus on real-world applications?

Yes! Look for books that include case studies or real-world examples, such as “Freakonomics” and “The Undercover Economist.”

Do I need a strong math background to read Macroeconomics books?

While some books may involve math, many are written for a general audience and focus on concepts rather than complex calculations.

Can Macroeconomics books help me with personal finance?

Absolutely! Understanding macroeconomic principles can provide insight into economic trends that affect personal financial decisions.